Buying a house is one of the biggest investments that you will ever make and it is a long term commitment. If you can afford to buy a house, it is well worth making the leap, as it is much better than paying money out in rent. However, it is important that you make sure that you can afford what you are buying as you don't want to be in a position in the future where you are worrying about meeting mortgage repayments. The first step in buying a property is calculating what house you can afford.

Use an income and outgoing calculator

If you haven't bought a property before you will want to work out what sort of house that you can afford and you might not know how to go about it at first. The easiest way to get an idea of what you can afford is to use an online calculator. Mortgage Calculators has a whole array of free online calculators that will help you with your finances. Their mortgage affordability calculator is really useful as a starting point.

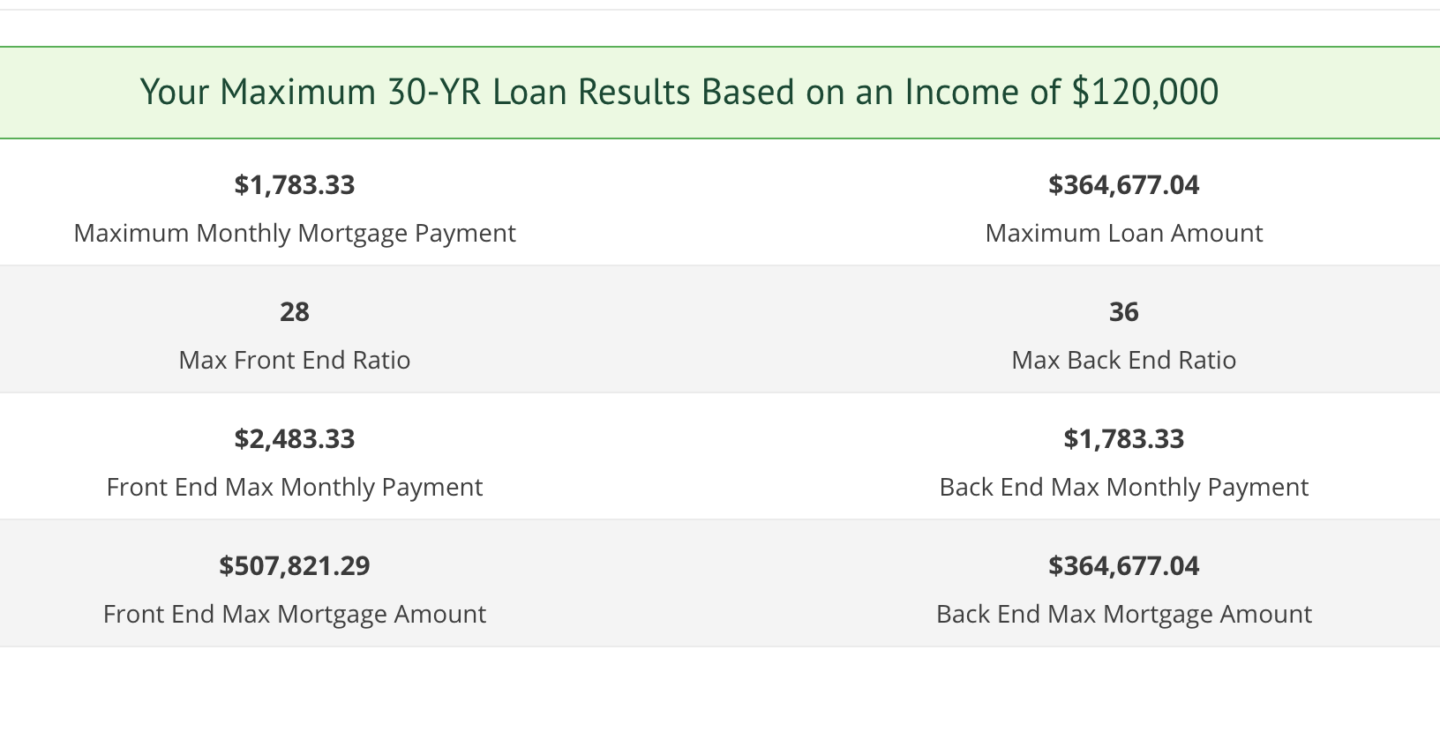

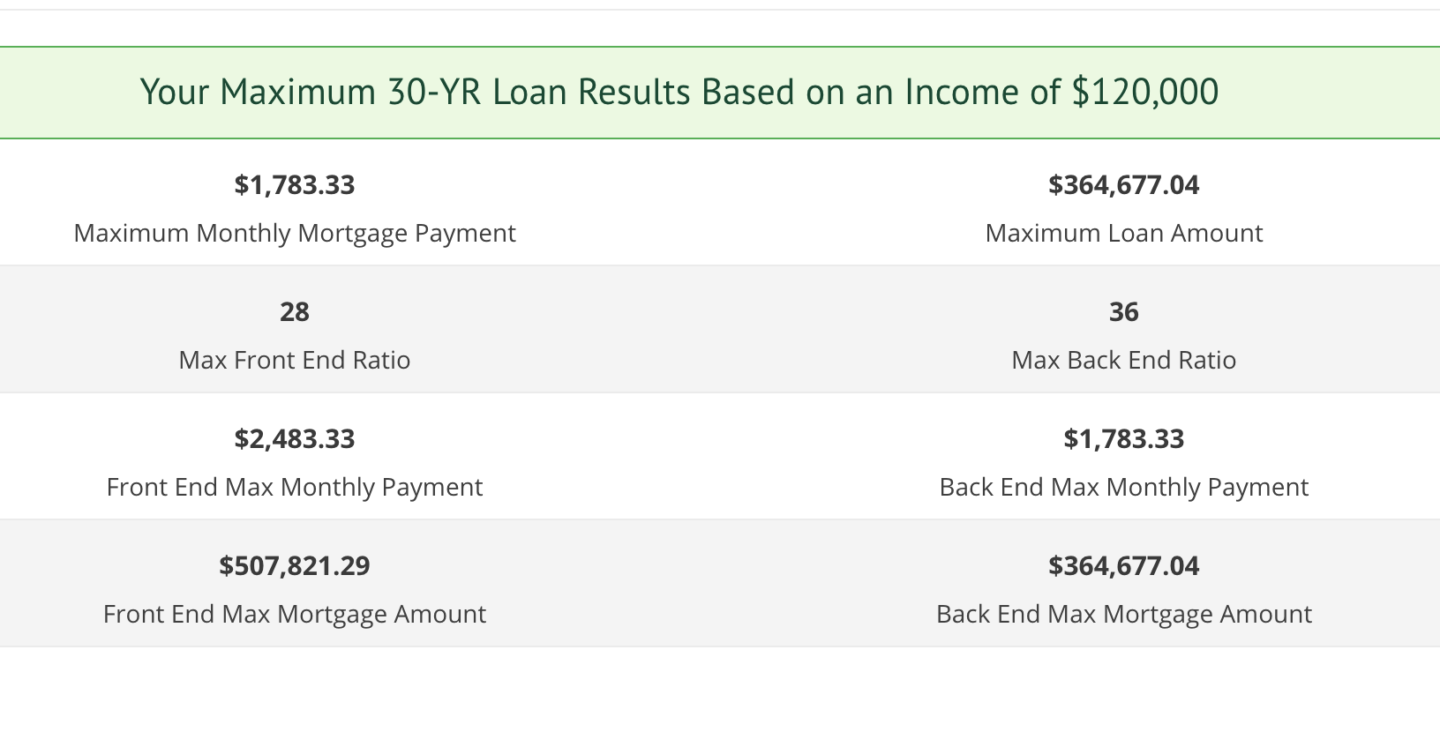

You input various figures such as you and your partner's income, along with any deposit, interest rate, term of mortgage, typical homeowner expenses, debts and press calculate.

It will work out how much you can afford to spend monthly on a mortgage, and in turn how much your maximum loan amount would be. The calculator is in USD but would work for any currency.

Working this out will give you a nice idea of how much you can spend on a house so you can start looking within that price bracket.

Save a deposit

If you are looking to buy a home you will want to save up a deposit. Different mortgage deals require different deposits, and a larger deposit may mean a lower interest rate. If you want to find out more about different loan options, here is an article that might help. You can have a play with the figures in the online calculator above, increasing and decreasing your downpayment figures to see how it affects what house you can afford. Broadly speaking, the bigger the deposit that you have the better so make sure that you start saving as soon as you can.

Renovation or redecoration costs

When you are thinking about how much you can afford to spend on a house you need to think about what type of house it is that you want to buy. Every property will need some sort of work done to it, from re-decoration to major renovation work. Make sure that you consider this in your calculations. If you have worked out a maximum amount that you are able to borrow make sure you take off the amount needed for redecoration and renovation expenses so that you will be able to afford them. If you are undertaking renovation work, Freddie Mac has some great tips on working with tradesmen to get the job done.

Consider future life changes

When calculating what house you can afford it is vital to bear in mind any future life changes. Will you want to be having a baby in the next few years? Your income might take a hit and your ability to pay your mortgage be affected. Other future plans such as travel, business set ups, a change in jobs etc. are all foreseen events that you should consider. If you know that you are planning any major changes such as these, which could affect your income then take that in to account.

Save for a rainy day

There will always be situations that arise that cannot be planned for or expected. Poor health, losing your job or even the current pandemic are all the sorts of events that can't be predicted, but this doesn't mean that you can't be prepared for them. Events like these are why it's crucial that you don't max out your affordability - give yourself some buffer room in case of a rainy day. Ideally you would use that buffer to top up a savings account which you can use as an emergency or rainy day fund.

The Money Advice Service advises that you should have a minimum of 3 months of essential outgoings available in an instant access savings account. This would enable you to pay your mortgage, bills and food for 3 months in an emergency situation.

We hope that you found this post with tips on calculating what house you can afford useful. Share it with your friends or Pin it for later...

If you liked this post you might also like...

Leave a Reply