Life can be expensive sometimes. We have spent the last 4 years determined to pay off all our debts and as we both had huge student loans it has taken us a lot of time and dedication. I did however in the process learn some very clever tricks of how to budget well and little ways to make the most of any deals we could get. Most of us will need to borrow money occasionally though and it is important to work out the cheapest way to borrow money and to pay it back quickly.

We save a regular amount each month which goes into a savings account for a rainy day when the car needs fixing or the washing machine breaks. But as we all know, things like this usually happen in threes so sometimes the rainy day fund is left empty. What do we do then?

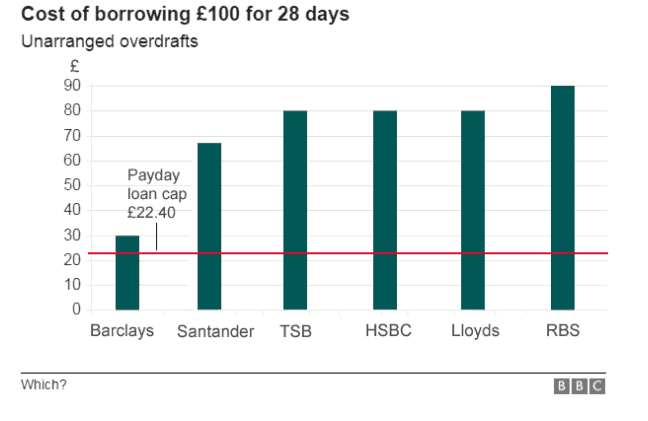

If the amount you need to borrow is between £100 and £500 you could consider getting a payday loan from a reputable company. As long as you have a dedicated plan for paying it back they can actually be cheaper than using an unauthorised overdraft says Which?

The trick is to look very carefully at the cost of what you want to borrow and pay it back as quickly as you can. It is always better to put a plan into place when you are dealing with unexpected expenses, as this shows, if you just use your overdraft it can be quite costly - some unplanned overdrafts can cost a huge £6 a day with a £90 cap per month. This is in contrast to the £22.40 cap on charges for borrowing £100 for 28 days from a payday lender.

I'd never recommend getting into debt unless is it totally unavoidable. If we want to go on holiday we save up for it and we don't go until we can afford it. It is slightly different when something goes wrong and you need to find the money quickly for it and this is where loans like this have their place, if used properly and wisely.

Like this post? Pin it for later...

This is a collaborative post.

Leave a Reply