Embark on the 'Save £10k in a Year Challenge' with our comprehensive guide! Discover practical tips on saving and earning extra money monthly while tracking progress with a free printable chart. Start your journey to financial freedom today!

This post contains affiliate links and I may receive a small commission if you visit a link and buy something. Purchasing via an affiliate link doesn’t cost you any extra, and I only recommend products and services I trust. I may have been sent some of the products in this post free of charge or paid to feature them here. Thank you for supporting this blog.

Jump to:

Are you looking to improve your financial health and build a solid savings cushion? The Save £10k in a Year Challenge might just be the perfect strategy to kickstart your savings journey. Saving £10,000 in a year may seem like a daunting task, but with proper planning, dedication, and some helpful tips, it’s an achievable goal that can pave the way toward financial security. This challenge isn't just about socking away money; it's about cultivating smart spending habits, finding innovative ways to save, and possibly even boosting your income. Let's dive into the details of this 52-week money challenge and explore practical tips to help you achieve your savings goal.

Everyone will be in a different financial position - if you are debt free and free from credit cards you could consider this £10k to be your emegency fund, as recommended by Dave Ramsey for example. If you already have an emergency fund and are debt free then you might want to use the £10k to give as a gift to a child towards their home deposit or a down payment for something, for a nice holiday for yourself, topping up your bank account or for college fees. The thing is that £10k is a lot of money - probably much more money than you imagine that you could save in a year but it is great to have financial goals and breaking them down in this way in an great way of achieving your savings goals.

The Save £10k in a Year Challenge Explained

The concept behind the Save £10k in a Year Challenge is simple: save a set amount of money each week to reach a total of £10,000 by the end of the year. For instance, if you break down £10,000 over 52 weeks, it comes down to saving approximately £192 per week. However, finances and commitments can change from week to week so we have set out the challenge in bite size chunks over the course of 52 weeks, meaning some weeks you will be able to save a larger amount - up to £220 a week and some weeks slightly less, perhaps £180 per week.

Setting Realistic Goals

While the challenge’s name suggests saving £10,000 in a year, it’s crucial to adjust the target according to your financial situation. Not everyone can save the same amount consistently. Evaluate your income, expenses, and financial obligations before committing to a specific goal. Setting a realistic target that aligns with your income and expenses is essential to avoid financial strain. It is important to be honest with yourself about how much money you think you can bring in per week and how much you will be able to dedicate to a money-saving challenge. You want the goal to be ambitious but ultimately achievable. If you are on a lower income or just at the beginning of your financial journey you might want to set a lower goal.

Creating a Budget

Developing a budget is the cornerstone of effective money management. Track your income and expenses to understand where your money goes each month. Identify areas where you can cut back or eliminate unnecessary spending. Remember even small amounts of savings add up week by week. By adhering to a budget, you can allocate a specific portion of your income towards savings, making it easier to meet your savings goal.

Practical Tips for Saving Money Each Month

1. Cut Unnecessary Expenses

Review your monthly expenses and identify non-essential items that you can reduce or eliminate. Subscriptions, dining out, impulse purchases – these are areas where small changes can make a significant impact on your savings. Every saved dollar amounts to an extra dollar in the savings. Try to leave your debit card at home when shopping - take out a specific amount of cash to buy what you need and you won't be able to overspend without your bank card.

2. Automate Savings

Set up automatic transfers from your checking account to a dedicated high-yield savings account. Treat your savings as a fixed expense, just like your rent or utilities. This way, you'll be less tempted to spend the money you intended to save. Set the savings payment to come out in the first week after payday if you are paid monthly. This is when you will miss the chunk of money the least and you can spend the rest of the month sticking to budget in order to keep spending within your available limit.

3. Use Cashback and Rewards

Make the most of cashback offers, rewards programs, and coupons when making purchases. Websites and apps often offer cashback on everyday spending, effectively giving you a discount and allowing you to save the extra cash. As soon as I cash out from a cashback account I move that money straight over to my savings account. It is bonus money you weren't expecting to receive and will be a welcome help towards your weekly goal. I use Quidco, Hyperjar and TopCashback mainly when shopping online but many bank accounts have their own cashback incentives too. The trick is to sign up to as many as you can so that most of your online purchases will come under one or the other and you also get to choose which gives you the best cashback rate if the retailer is in the cashback programme of more than one company.

4. Cook at Home and Meal Prep

Eating out frequently can significantly impact your budget. Try cooking meals at home and meal prepping for the week. Not only is it cost-effective, but it also promotes healthier eating habits. I find that shopping online with a strict shopping list for the week is the best way to stop me from making frivolous impulsive purchases (hello Aldi middle aisle!!) This probably cuts down our weekly shopping bill by £10-20 a week, meaning these weekly savings can be put towards the savings plan.

Earning Extra Each Month

Apart from cutting expenses, increasing your income can expedite your savings journey. After all, you might well have trimmed down your budget as much as you can, meaning the only way to hit your savings goal is to earn more money. Here are some practical ways to earn extra money:

1. Freelancing or Side Hustles

Utilize your skills and hobbies to take on freelance work or start a side hustle. Whether it's graphic design, writing, tutoring, or pet sitting, there are various opportunities to earn additional income. Sign up to sites such as Fiverr or Upwork or offer your services on a local or niche facebook group. The good news is that you will definitely have a skill that will enable you to be good enough at something that another person will pay you for your help.

2. Renting Unused Space

If you have a spare room, consider renting it out on platforms like Airbnb or inviting in a more permanent lodger. You can also rent out parking spaces, storage space, or even equipment that you don’t use regularly. This is a great way to earn passive income from something that you already own, without much extra work and can bring in a significant amount of cash, especially if you live somewhere where parking is in short supply or near to a stadium or venue that people are looking at staying near for a night or two occasionally.

3. Selling Unwanted Items

Declutter your home and sell items you no longer need. Use online marketplaces or organize a garage sale to turn your clutter into cash and some important extra income. I really like eBay and Vinted for selling things online, as well as Facebook marketplace. The first step is to make a pile of things that you no longer want or need and might have re-sale value, then list a handful of them on a selling site each day. I post a Vinted parcel most days which brings in a couple of pounds a week to put towards the savings tracker. Make sure every family member takes a look through their belongings too for things that they no longer want or use and could be sold.

4. Participating in Surveys or Focus Groups

Many companies pay for opinions through surveys or focus groups. While these may not generate substantial income, they can provide extra cash for minimal effort and it all adds up. My favourite is Prolific but there is also YouGov and Swagbucks which I use too.

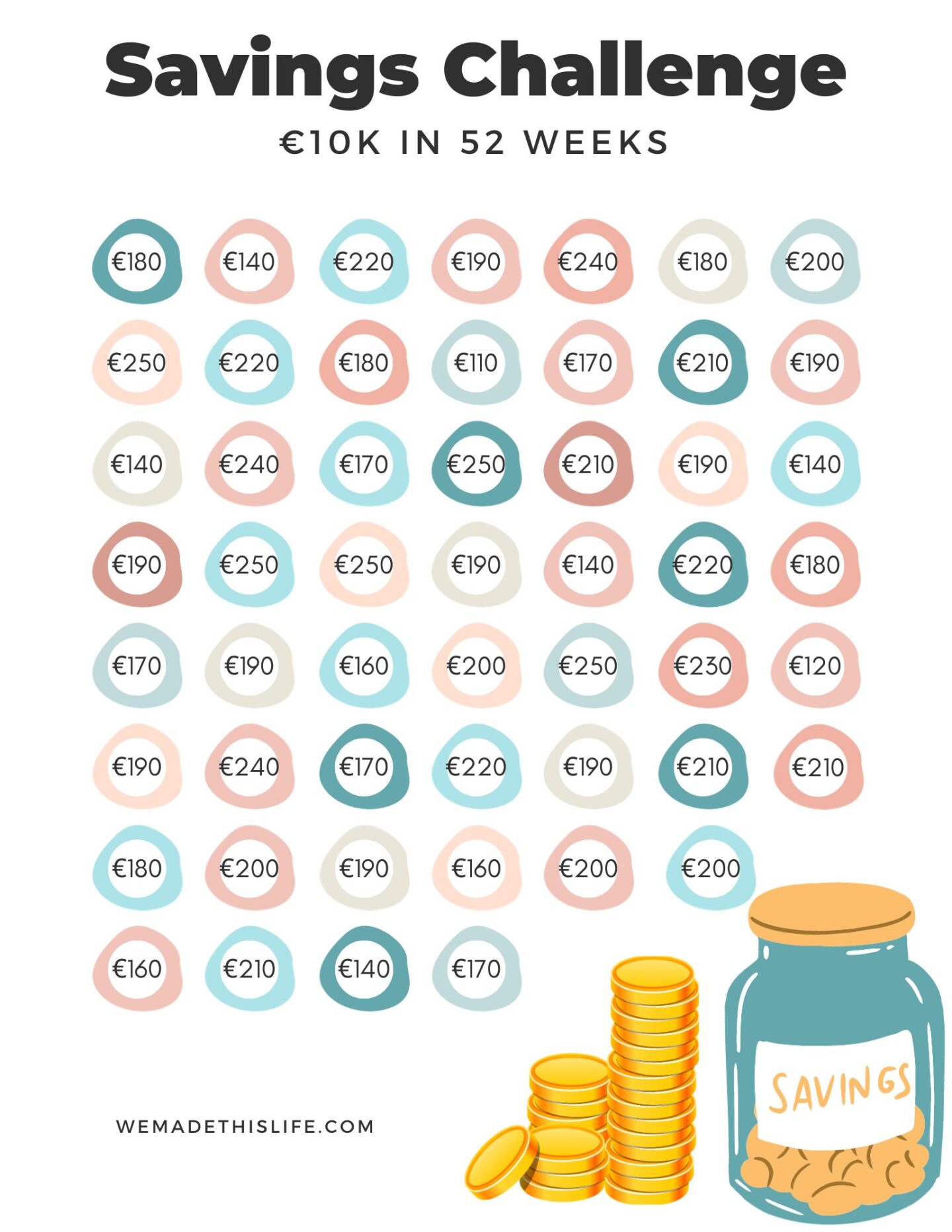

Free Printable Chart to Track Your Progress for the Save £10k in a Year Challenge

To stay motivated and track your progress throughout the Save £10k in a Year Challenge, consider using a printable savings chart. This visual aid can help you see how far you've come and how much closer you are to reaching your goal. Its a fun way of monitoring your progress and keeping you on track. Simply cross off an amount each week that you have managed to save.

I have uploaded three different versions of the Save £10k in a year challenge - one in pounds, one in dollars and a third in Euros. Just click on each image below to download each version.

You can mark off each milestone as you progress, reinforcing a sense of accomplishment and encouraging you to stay on track. If this particular savings challenge isn't for you, you can choose to do a penny challenge or a 100 day challenge, anything that works for you and financial situation and goals.

Conclusion

The Save £10k in a Year Challenge is more than just a savings goal; it’s a journey toward financial discipline and empowerment. From the first day to the end of the challenge you will be thinking about saving money and also earning extra money. By the end of the challenge this should become more like second nature to you and set you up for financial security in the future. By implementing practical saving strategies, adjusting your spending habits, and exploring avenues to increase your income, you can set yourself up for long-term financial stability. Remember, consistency is key. Small, consistent efforts each month will eventually lead to significant savings by the end of the year. Embrace the challenge, stay focused, and watch your savings grow, paving the way for a more secure financial future.

If you enjoyed this post about the save £10k in a year challenge, you might also like these other money related posts...

- What to Expect During the Mortgage Application Process

- What’s the Difference Between Selling for Cash and Listing With an Agent?

- Best Photography Niches for Making Money

- 5 Ways to Protect Your Finances in Uncertain Times

Don't forget to share this save £10k in a year challenge with your friends, on social media and Pin it for later.

Leave a Reply